Are you looking for suitable software for your bank? But you have individual requirements and needs that a standard solution does not fulfil? Then soxes is the right partner for you. We have specialised in individual software development for more than 20 years and are partners of numerous well-known banks and insurance companies such as UBS, Raiffeisen Switzerland, Zürcher Kantonalbank, Vontobel, Bank Linth, AXA, Zurich Insurance, Celsius Pro and many more!

Customised software for banks and insurance companies

Digitalisation in the finance and insurance industry

The insurance and financial sector is undergoing profound change worldwide due to ongoing digitalisation. This brings with it both opportunities and challenges that are prompting companies to rethink their strategies in order to remain competitive and at the same time respond to the needs of a changing customer base. Risk management, data security or AI-driven analyses and processes – this and more is what the banking and insurance industry will be facing in the future.

Customer expectations and the need for digitalisation

Today’s customers and sales partners have redefined their expectations as a result of advancing digitalisation. They not only expect pure transaction processing, but a holistic customer experience that is personalised, efficient and seamless across different channels. Banks and insurance companies are therefore faced with the challenge of fundamentally transforming their services and processes in order to fulfil these expectations.

Limitations of standard solutions and the importance of flexibility

Standard solutions or banking software based on generic functions and systems often reach their limits in this context. The finance and insurance industry is dynamic and subject to constant change due to regulatory adjustments, technological advances and changing market trends. Prefabricated standard software packages often prove to be inflexible and incapable of reacting to changing requirements with the necessary agility.

Customer-centred technologies as the key to overcoming challenges

Customised software for the finance and insurance industry must therefore be based on customer-focused technologies. Various key concepts play a decisive role here:

Customer Experience (CX): customer centricity is at the heart of every innovative software solution. By creating personalised, seamless and consistent customer experiences, loyalty is strengthened and long-term customer relationships are promoted.

Flexibility and adaptability: The software must be flexible enough to adapt quickly to changing market conditions, new regulatory requirements and customer preferences. This requires a modular architecture and the ability to easily integrate new functions.

Innovative processes: Digitalisation opens up scope for innovative processes that go beyond traditional transaction workflows. Intelligent automation, machine learning and analytics make it possible to develop customised solutions that create real added value.

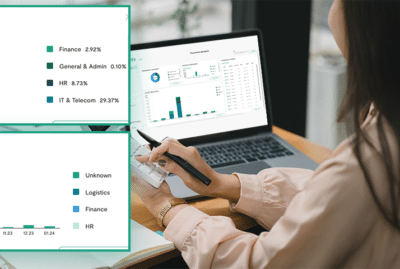

Our customers in the insurance and finance sectors

In order to fully exploit the benefits of digitalisation in the finance and insurance industry, a partner is needed who can provide forward-looking advice, support and create solutions. soxes has realised a powerful pricing tool for the collection, validation and utilisation of various market data for the Raiffeisen Group. The pricing tool was developed using Java, which offers performance and security advantages in many respects. AXA Winterthur is also one of our customers. It has benefited from the development of innovative projects for risk assessment and alerting solutions. Tradition and digitalisation go hand in hand – as demonstrated by our digitalisation programme at Reichmuth & Co, a traditional specialist in wealth management. Here, soxes has realised a complex advisory tool.

CelsiusPro, a leader in weather derivatives and parametric insurance solutions in Europe, also relies on soxes to protect customers worldwide from extreme weather conditions. The web application developed by soxes integrates global weather data, calculates precise prices for derivatives and enables customers to retrieve them directly. This technological environment combines the .NET framework with Python. Thanks to soxes’ provision of developers, the platform was successfully redesigned, including a switch to robust databases and the integration of microservices. As a result, CelsiusPro is now better positioned globally, offering more accurate insurance calculations and a more efficient web application. The soxes developers are continuously implementing ideas to emphasise the importance of climate change in collaboration with CelsiusPro.

Digitalisation plays a major role in the banking and insurance industry. We count numerous well-known and large banks and insurance companies among our customers: UBS, Zurich Insurance, Basler Kantonalbank, Vontobel, Zürcher Kantonalbank, Credit Suisse, Bank Linth and many more!

Customised software vs. standard solution

The choice of customised banking software for banks and insurance companies opens up a number of advantages over standard solutions. These customised solutions not only provide an answer to current requirements, but also create the basis for a forward-looking, customer-oriented transformation and offer a multitude of advantages.

Customised solutions for specific requirements

Customised software enables banks and insurance companies to tailor their processes precisely to their specific requirements. In contrast to standard solutions, which are often generic and require compromises, customised software offers the flexibility to optimally support individual business models and processes. This leads to greater efficiency and smooth operations.

Using innovation as a competitive advantage

The rapid development of technologies requires continuous innovation in order to remain successful in a competitive environment. Customised software development enables banks and insurance companies to seamlessly integrate innovations into their digital processes. This allows them to react quickly to market trends, introduce new products and offer their customers innovative solutions at all times. This creates a clear competitive advantage over companies that rely on sluggish standard solutions.

Customer loyalty through personalised customer experience

Today’s insurance and banking customers expect more than just transaction processing – they are looking for a unique customer experience. Individually developed software solutions enable banks and insurance companies to offer customised services that are precisely tailored to the needs of their customers. From personalised user interfaces to individualised product recommendations, a customer-centric solution creates greater customer loyalty and fosters long-term relationships.

Flexibility for changing requirements

The finance and insurance industry is subject to constant change, be it through new regulatory requirements, technological advances, new software products or changing market dynamics. Customised software solutions offer the flexibility needed to adapt quickly to changing requirements. Companies can add modules, customise existing functions and thus react to changes in an agile manner – a luxury that standard solutions often cannot offer.

Our technologies

By combining state-of-the-art software solutions with industry-specific expertise, soxes enables its clients to overcome complex financial and insurance challenges with ease. The customised products and services of soxes facilitate the management of risks, optimise operational processes and improve the overall efficiency of selected companies in the financial and insurance sector. Among others, soxes has deployed and utilised the following technologies:

Discover all our sectors and technologies and don’t hesitate to contact us. We are sure that we have the right solutions to your questions.

Contact

Do you have any questions? Would you like to find out more about our services?

We look forward to your enquiry.

Contact us